Table of Contents (Click To Jump)

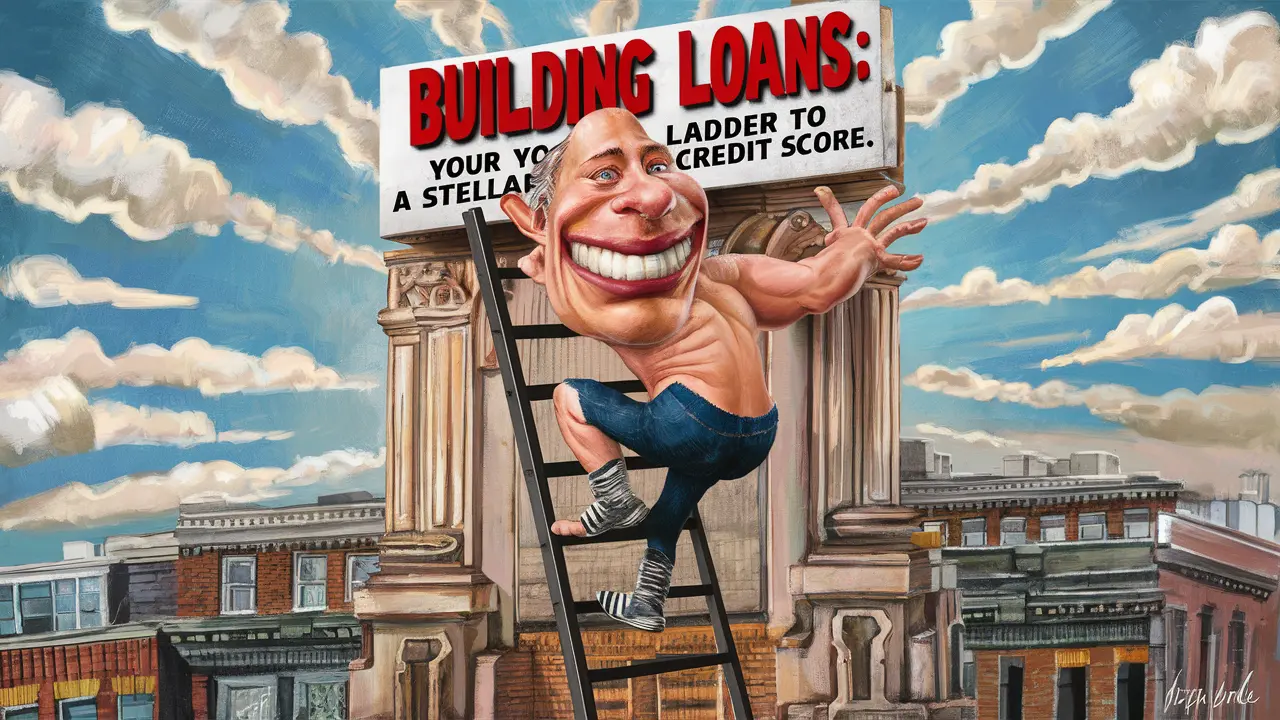

About 49 million U.S. adults, or one out of every five, lack enough credit history to be scored by common credit scoring systems. That’s a large number of people in a tough spot! Credit building loans come in as a great help here. They are especially useful for folks like DubG who are getting back on their feet after financial challenges, like a tough divorce.

For those wanting to build or improve their credit, credit builder loans are key. A strong credit score does more than help with loan approvals. It gets you better interest rates and opens doors to financial opportunities. This includes easily renting apartments and getting utilities set up.

Using smart ways to handle debt can help you reach a top-notch credit score. This is about paying bills when they’re due and managing various credit types well. The aim isn’t to encourage living in debt but to guide you towards financial growth and stability.

Key Takeaways

- Approximately one in five U.S. adults cannot be scored by standard credit algorithms.

- Credit builder loans offer a low-risk way to enhance your credit score.

- Building a solid credit score is crucial for loan approvals and securing favorable interest rates.

- Smart debt management includes on-time bill payments and managing various credit types.

- Credit building loans can help you unlock better financial opportunities.

Understanding Credit Building Loans

Let’s talk about credit-building loans. They’re like a helpful friend on your credit score journey. They’re made for people with low or no credit scores. Community banks, credit unions, and online lenders offer them to help you build or rebuild your credit.

What Are Credit Building Loans?

Credit-building loans act as a boost for your credit score. They range from $300 to $1,000. It’s a mix of saving and borrowing. The money “borrowed” is saved in a secure account. You pay it off monthly. When you finish paying, you get the money while your payments boost your credit score.

How Credit Building Credit Loans Work

With credit building loans, you don’t get money in hand straight away. Instead, your payments are saved in an account or CD. Let’s say you take out a $1,000 loan for 12 months at 5% APR. You’d pay about $86 each month, including $27 in interest. Your on-time payments improve your credit score. But a late payment can hurt your credit report for seven years.

Types of Credit Building Loans: Secured and Unsecured

There are two kinds of credit building loans: secured and unsecured. Secured loans need something valuable as collateral. If you don’t pay, you could lose your collateral. Meanwhile, unsecured loans don’t require collateral. They have higher interest rates and strict terms. Both types report your payment history to credit bureaus: Experian, TransUnion, and Equifax.

Which one will you choose? Secured or unsecured credit building loans? Either way, being timely with payments can lead to better credit and financial liberty.

Benefits of Credit Building Loans

Let’s explore the world of credit-building loans! These tools offer amazing help. They boost your credit score and open new doors for you. Credit building loans come with big perks.

Improve Your Credit Score

Did you know your payment history affects your credit score by 35 percent? Credit building loans shine here. By paying on time and reporting to bureaus, you improve your credit history. A study showed people with no debt benefit the most. So, pay on time and see your score rise!

Access to Better Interest Rates

Your better credit score helps you a lot. It lets you get lower interest rates on loans and credit cards. Now, that dream car is more within reach. This shows why credit building loans are key!

Enhanced Financial Opportunities

Imagine paying off your loan and having a top credit score. More opportunities come your way. You get lower security deposits and better credit card deals. And approval for needed services is easier! Credit building loans really open up your financial future.

How to Choose the Best Credit Building Loans

So, you’re ready to dive into credit-building loans. How do you choose the best one without getting lost in details? I’ll make it simple for you.

Comparing Loan Options

Start by comparing the available credit-building loans. Credit Karma and Credit Strong offer loans from $1,000 to $25,000. It’s important to line them up side by side. Look at reviews and compare based on your needs.

Evaluating Interest Rates and Fees

Interest rates and fees are crucial when choosing a loan. Rates can vary wildly from 5 to 36 percent. For example, MoneyLion’s APRs go from 5.99% to 29.99%. A high APR can quickly turn a loan from a help to a burden.

Loan Approval Criteria

Before setting your heart on a loan, see if you’re likely to qualify. Lenders check your income, job stability, and debt ratio. Knowing what they want can help you find a loan you’ll get approved for.

With knowledge on how to compare loans, evaluate costs, and understand approval criteria, you’re ready. Always look for trustworthy resources when making your decision.

Tips and Strategies For Using Credit Building Loans Effectively

You’ve got a credit-building loan—congrats! Now, it’s time to build a great credit score. Before celebrating, let’s look at some killer tips and essential advice to make your loan work for you.

First up, always pay on time. No excuses! Whether it’s a lazy day or your dog’s begging, pay on time. Making payments when they’re due shows creditors you’re reliable.

Now let’s tackle credit utilization. It may sound dull, but it’s key. Aim to use less than 30% of your credit limit. For example, if your limit is $1000, spend less than $300. This stops you from overspending.

Here’s a trick: become an authorized user on another’s credit card. It’s a smart way to benefit from their good credit habits. Choose a family member or friend who handles credit well to boost your score faster.

Check out Experian Boost. It lets you add cell phone and utility payments to your credit report. Since you’re paying these bills already, let them help your credit score.

Ever explored rent-reporting services like Rental Kharma and LevelCredit? If not, you should. They report your rent payments to credit bureaus, which can help your credit score.

Be cautious with credit card applications. Applying for many cards in a short time can hurt your score. Choose wisely, selecting only one or two cards.

A quick tip: don’t close old credit card accounts. Having them open benefits your credit usage and account age. These are good for your score.

It’s common to find errors on credit reports. Go to AnnualCreditReport.com and dispute any inaccuracies. Doing so is free and could raise your score.

Lastly, monitor your credit score. Sign up for services offering monthly FICO score reports. Some credit card providers give you this info in your statements or online. Stay informed!

Use these credit building loan tips wisely. With smart and consistent actions, you’ll maximize your loan’s benefits. It’s all about making the right financial moves.

Common Myths About Credit Building Loans

There’s a lot of confusion about credit building loan myths. We’re here to clear things up.

Myth: You Must Have Existing Credit to Get a Loan

Many believe you need existing credit for a loan. That’s not true. Products like the Tomo Credit Card are for those with no credit. So, even if you have no credit history, you’re still in the game.

Myth: All Credit Building Loans Are Expensive

Some say all credit building loan features are costly. But that’s not the whole truth. There are many affordable options out there. You just need to look a bit.

Yes, some loans have high rates, but not all. Don’t worry, not every credit building loan will empty your pockets.

Myth: Credit Building Loans Are Only for Bad Credit

Another wrong idea is that these loans are just for bad credit. That’s not correct. These loans help newcomers to credit or those expanding their credit. They’re good for many people, not just those fixing their credit.

Conclusion

So, let’s sum up what we’ve learned about credit building loans. They’re great for fixing past financial mistakes or improving your credit. These loans work like a personal coach for your credit score. They have low upfront costs and offer small amounts to borrow. These loans are your supportive buddy, always reminding you to pay on time. And timely payments can hugely boost your credit profile.

Building a good credit score doesn’t happen fast. With credit builder loans, you need patience and regular monthly payments. Making payments on time is key. These loans help you build a positive payment record and increase your creditworthiness. It’s like working out for better financial health.

For the 28 million “credit invisibles” and 21 million “unscoreables” in the U.S., these loans are a big help. They’re available even if your credit isn’t great. By using these loans and other credit types, you can develop a strong credit history. Think carefully about your choices and take steps to improve your credit score. Embrace proactive credit management. Here’s to achieving great credit scores as your new reality!

FAQ

What are credit building loans?

Credit building loans help people start or boost their credit scores. You need to make payments on time. These are reported to credit bureaus, helping your credit score grow.

How do credit building loans work?

With a credit building loan, the money you borrow is put into a savings account. You pay the loan off over time. After you pay it off, you get the money. Your payments are reported to credit bureaus, raising your credit score.

What are the types of credit building loans?

Credit building loans come in two types: secured and unsecured. Secured loans need collateral like saved money. Unsecured loans don’t need collateral but usually have higher interest rates.

How can credit building loans improve my credit score?

Making timely payments on your loan shows you’re responsible. This can make your credit score better over time.

Will a better credit score help me get better interest rates?

Yes! A higher credit score shows lenders you’re less of a risk. This can mean lower interest rates for you.

What other financial opportunities come with a better credit score?

A better credit score can offer many perks. You might pay less security deposit on rentals, get higher credit card limits, and get easier approvals for services like utilities and phones.

How should I compare different credit building loan options?

Look at loans’ interest rates, fees, terms, and who’s giving the loan. Choose one with affordable payments and no hidden fees.

What should I consider regarding interest rates and fees when choosing a loan?

The Annual Percentage Rate (APR) is crucial. It includes interest and fees. A lower APR costs less over time. Make sure the fees are fair and won’t strain your budget.

What criteria do lenders use for loan approval?

Lenders check your income, job stability, and how much debt you have. Even with a low credit score, these can help you get approved.

What are some tips for using credit building loans effectively?

Always pay on time, watch your credit use, steer clear of too many credit applications, and keep an eye on your credit score. These steps can boost the effect of your credit building loan.

Is it true that you must have existing credit to get a credit building loan?

No, that’s a myth. Some loans are meant for those without credit history. The Tomo Credit Card is one example for newbies to credit.

Are all credit building loans expensive?

Not at all. Despite some having higher fees and rates, there are affordable options. Comparing can help you find a good deal.

Are credit building loans only for people with bad credit?

Another myth. They’re for anyone wanting to work on their credit. This includes young people, newcomers to the U.S., and those fixing their finances.