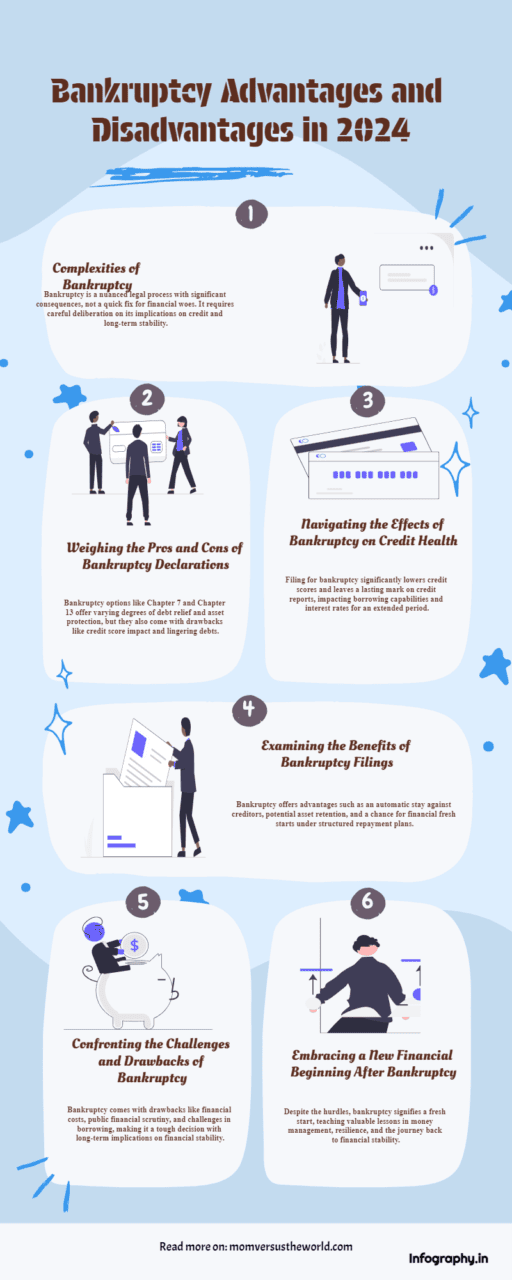

Table of Contents (Click To Jump) [show]

Declaring bankruptcy isn’t like pressing a big, red, drama-filled “easy” button. It’s anything but a financial game show where you waltz off stage, debts disappearing into thin air. Nope. Diving into this realm myself, I’ve come to know it intimately as a complex journey filled with more twists than a prime-time drama. And when it comes to the disadvantages of bankruptcies in 2024, let’s just say, it’s a mixed bag that deserves a hard look before leaping.

Bankruptcy can feel like being in a high-stakes poker game where your assets are on the line and the house — in this case, the court — seems to always have the upper hand. You’re faced with options like Chapter 7, where your assets could vanish quicker than ice melts in August, or Chapter 13, akin to dieting during the holidays — reorganizing debt but still yearning for that financial freedom. Sure, the idea of shedding some debts might seem appealing, but the disadvantages of bankruptcies in 2024 carry weighty implications, potentially affecting not just your immediate financial health but your dignity and future stability too.

Embarking on this path requires a delicate balance, weighing the potential relief from creditors against the impact on your creditworthiness. Trust me, navigating this financial thicket is more akin to an “oh brother” moment than a celebratory one. So, let’s delve into the specifics, maintaining a straightforward and authentic tone throughout.

Key Takeaways

- Bankruptcy isn’t just a ‘get out of jail free’ card—it’s a legal process with hefty consequences.

- Chapter 7 can liquidate your assets faster than you can say “garage sale,” while Chapter 13 restructures your debts like an overzealous personal trainer.

- The feeling of relief from debt collectors is one of the major declaring bankruptcy benefits, but it comes at a price.

- Understanding the bankruptcy implications means acknowledging the impact it will have on your credit report for the next decade.

- Weighing bankruptcy decision factors is a serious game of pros and cons, where the end goal is solvency, not simply a slap on the wrist.

The Pros and Cons of Declaring Bankruptcy

It’s like going to a buffet only to find out half the dishes are kale salads; declaring bankruptcy has its mix of bankruptcy advantages and disadvantages. Is it a dive into a pool of ‘get out of debt-free’ cards or just a collective groan echoing through empty pockets? I’m here to dish out the scoop, sans sugarcoating.

Let me paint you a picture of relief: You’re being chased by a rhino-sized pile of bills, and suddenly, you invoke this magical automatic stay. It’s like a force field in this bankruptcy protection effects game, halting foreclosures and repossessions faster than you can say “Not today, bills!” In the world of Chapter 7, you might get to ditch unsecured debts, but alas, student loans and child support stick to you like gum on a shoe—it’s not all wiped clean.

- Pause on Payment Demands: When you declare, it’s like a freeze ray on creditors. “Stop right there,” says the automatic stay.

- Potential to Ply Your Property: You might just hang onto your car and crib, no desperate garage sale is needed.

- Debt Diet: Unsecured debts can take a hike, but hefty debts like student loans are the uninvited guests who won’t leave the party.

And for my friends who dig the do-over vibes of Chapter 13, it’s like a reset button for your debt—only it comes with an intense repayment workout plan. You’ve got some breathing room, but your spendthrift ways will be on a tight leash.

| Chapter 7 Bankruptcy | Chapter 13 Bankruptcy |

|---|---|

| Ditch your debts like a bad Tinder date (mostly) | Reshape your debts into something you can handle (think of it like debt Pilates) |

| It’s a speed date with assets liquidation | Steady relationship with your stuff while you pay off the ex… debts |

| Credit score takes a nosedive | Credit’s on a diet, but still gets to live a little |

| Can be a financial K.O. in 4-6 months | Will drag out for 3-5 years but feels less like a knockout punch |

But let’s not skip the fine print, the flip side, the ‘yeah, but’ of declaring bankruptcy. Remember that bankruptcy’s got its name in lights on your credit report for a decade—it’s the guest who overstays and then some. Plus, don’t even get me started on the costs: Filing fees, attorney costs—it’s like throwing a pay-to-lose party.

- The Credit Conundrum: Saying bye-bye to creditors also means your credit score gets shredded like cheese on taco night.

- Financial Fatigue: With Chapter 13, it’s a marathon, not a sprint—you’ll be paying off debts for what feels like eons.

- Asset Anxiety: Can you keep your things? Maybe, maybe not. Depends on the mercy of exemptions.

Bottom line: In this bankruptcy process overview, it’s clear as mud—I mean, clear as crystal—that bankruptcy can swing from lifebuoy to anchor. You might breathe a sigh of relief or gasp for fiscal air depending on which side of the bankruptcy fence you land. Weigh these bankruptcy advantages and disadvantages like they’re your grandma’s heirloom tomatoes—delicately, with care, and maybe a dash of salt.

Understanding Bankruptcy Effects on Credit

Let’s shed some light on the bankruptcy boogeyman hiding in your financial closet—the one that goes by the name of “effects on credit.” It’s like a tattoo on your financial history; no matter how much you want to forget that wild night out, it’s etched in there good and proper, for the whole world, especially lenders, to see. Oh, and not just for a little while—this ink lasts for 7-10 years on your credit report, making every attempt to borrow money feel like running a marathon with a piano on your back.

Choosing the bankruptcy route, be it Chapter 7 or 13, expect your credit score to nosedive like a superhero without the flying gene. “To infinity and beyond?” More like, “To the depths of despair, and stick around for a while.” And let’s talk about post-bankruptcy life, shall we? Say hello to your new pals, higher interest rates, and uh-oh borrowing conditions. Just thinking about scoring a mortgage or a new set of wheels becomes a test of financial fortitude where you’re likely to encounter the skepticism of a guarded, bespectacled banker looking at you over their half-moon glasses with a raised brow.

But wait, there’s more! If renting is more your tempo, don’t be surprised if that bankruptcy tat on your credit report elicits furrowed brows from landlords, turning apartment hunting into an extreme sport. Sure, you’ll find a place eventually, but get ready to lay down some extra security money as if you’re trying to secure a fortress. At that point, you might as well use that money as a down payment on a house, because it’s not that far off from what you’d need.

And let’s not gloss over the career conundrum. Depending on the gig, having a bankruptcy plastered on your record could shut more doors than a high school janitor at 3 PM. It’s like walking around with a sign that says “I’m a risk,” which isn’t exactly a confidence booster in the professional world.

- Initial Credit Score Plummet: Your score takes a hit worthy of a superhero smackdown.

- Struggle Street for Borrowing: Every cent you borrow could cost you more in interest.

- Trust Issues: Good luck getting creditors to swipe right on you anytime soon.

- Job Hunt Hurdles: Some careers may consider you the personification of the red flag emoji.

- Long-term Planning Is a Must: You’ll need a vision board, a spreadsheet, and a magic 8-ball to navigate your financial future.

But here’s the kicker: despite the gnarly reality check, declaring bankruptcy isn’t financial armageddon. It’s not like you’re banned from ever owning a credit card or being granted a loan again. No, it’s about pulling up your bootstraps, wading through the credit quicksand, and clawing back your financial mojo with sheer grit. So, while bankruptcy plants a big, red flag on your credit report, it’s not the end of the world—it’s the beginning of a new, budget-conscious life script.

- New Start Vibes: Banish those old debts to the shadow realm and look forward to a cleaner (albeit tighter) fiscal chapter.

- Credit Rebuild Challenge: Life after bankruptcy is a puzzle where every payment made on time, every avoided splurge, fits a piece back into your credit score mosaic.

- Borrowing Becomes a Game: It’s like “Whose Line Is It Anyway?” The rules are made up and the points don’t matter—except the points are your credit score, and they matter a lot.

Let’s face it, the bankruptcy bungle isn’t ideal. But if you play your cards right, keep your spending savvy, and budget like a beast, you can bounce back. Rebuilding your blue-chip status will take the patience of a saint and the discipline of a drill sergeant, but it’s doable. So take bankruptcy’s lasting scar on your credit report for what it is—a hurdle, not a halting. There might be some tumbles along the path, but you’re on the trail to credit redemption, my friend.

A Closer Look at Bankruptcy Advantages

As I waded through the murky waters of financial failure and tossed myself a lifeline by declaring bankruptcy, I uncovered a shiny buoy I like to call ‘declaring bankruptcy benefits’. Take the vaunted automatic stay, for one. Ah, the sweet silence as the incessant drone of creditors’ calls is muted, giving me that much-needed breather to regroup. The rest of the world may be caught in a frenzy, but in my bubble, it’s zen and the art of financial maintenance.

The possibility of a fresh financial start isn’t just a whisper in the wind. It’s a real thing when bankruptcy protection effects kick in. Foreclosure and repo men lurking around every corner? Not for this guy. With a little help from Chapter 13’s reorganization and structured repayment, my home remains mine. It’s akin to fortifying a sandcastle before the tide rolls in—precarious, sure, but possible.

Now, Chapter 7 is a bit like a financial diet pill—quick but tough on the system. In a blur, it wipes away substantial debts, like a magic eraser for those regrettable inky blots on my ledger. But let me be clear: essential assets like my old clunker of a car and my not-so-palatial abode potentially get a pass from the insatiable hunger for liquidation, thanks to exemptions.

In this whirlwind aftermath of a financial storm, having a court-appointed trustee is like anchoring to a sturdy branch. They stand by, a steady hand amidst the chaos, ensuring that through all the tumult, a semblance of structure and relief exists. Truly, one of the biggest advantages lies in the finality that the process provides—no take-backs, no ‘just kidding’, just a staunch path forward.

- An automatic stay that hits the pause button on creditor harassment.

- The comforting notion of a fresh start without the nightmare of foreclosures.

- Repossession attempts? Not in my backyard, thanks to Chapter 13’s defense.

- A potential escape from liquidation for the essential assets I need to survive.

- Finding solace in the finality and advocacy of a court-appointed trustee.

When it comes down to it, declaring bankruptcy isn’t a dive into an abyss. Instead, it’s a parachute that softens the landing when your finances have decided to freefall. Sure, thinking about bankruptcy may have you picturing yourself as the runaway cartoon character, zigzagging away from a tumbling avalanche of bills. But the pros of filing for bankruptcy serve as a welcome pitstop—where you catch your breath, bandage your knees, and prepare to climb out of the valley of debt with renewed resolve.

Confronting the Drawbacks of Filing for Bankruptcy

Ever gone skydiving only to realize you’re wearing lead boots? That’s kind of like dealing with the aftermath of bankruptcy—it’s like you’ve willingly stepped into the deep end with weights strapped to your feet. You’re not just drowning in debt; now you’ve got the anchor of drawbacks of filing for bankruptcy pulling you even further down the financial abyss. But hey, who said rebooting your fiscal life was going to be like a leisurely stroll in the park?

Picture this: you’re already broke, and now you’re shelling out stacks of green to cover those exorbitant lawyer and filing fees—because who doesn’t like the irony of spending money you don’t have to tell the world you’re broke? It’s practically throwing a party you can’t afford, where the guest of honor is your depleted bank account. And this isn’t just a kick to the wallet; it’s a roundhouse to your dignity.

Yes, it’s true that a clean slate is on the menu, but so are the lifelong companionships with student loans, child support, and taxes. These guys are like the houseguests who have overstayed their welcome, eaten all your food and are now firmly planted on your couch. And when it comes to buying on credit? Think high-interest loans with rates that would make a loan shark blush or, even worse, that stone-cold rejection letter that hits your mailbox with a thud.

The fun doesn’t stop there. When you declare bankruptcy, you’re stripped bare for the world to see—every Tom, Dick, and nosy neighbor will know about your fiscal fiasco. It’s an open-book test where your credit report is on full display. This isn’t just a bad hair day level of embarrassment; it’s a “I just tripped on the catwalk in front of a live audience” kinda deal.

- Credit Score Nose Dive: Your credit’s going down faster than a cellphone signal in an elevator.

- Interest Rate Skyrocket: Ready for interest rates that are out of this world? Hope you like astronomical figures.

- Loan Rejection Salt Bath: Just when you need a financial hug, get ready for the cold shoulder.

- Persistent Debt Stench: Those ‘forgiven’ debts? Some linger around like last week’s fish dinner.

- Public Financial Undressing: Hope you’re comfy with your money issues making headlines in your local gossip column.

Let’s not sugarcoat it — if you opt for bankruptcy, be prepared for a season or ten of the ‘financially untouchable’ vibe. It’s like falling off the money map and into a creditor’s version of a witness protection program. But fear not! I’m living proof that while you might have to swim through a sea of financial stigma, you can eventually make it to shore. Just gotta keep kicking those concrete shoes.

Conclusion

If you’ve stuck with me on this wild financial rodeo ride, props to you. Declaring bankruptcy, my friends is like flipping the game board when you’re losing: disruptive and full of consequence, but sometimes it’s the only move left. It’s that final, desperate call to the financial cavalry when the tidal wave of debt threatens to wash away your earthly possessions, piece by piece. Bankruptcy decision factors? They’re more complex than my family’s recipe for Thanksgiving stuffing—and let me tell you, that’s saying something.

Bankruptcy implications snake around your credit report like Ivy, but not the pretty kind you post on Instagram—this stuff is thorny and wraps tight and makes you itch worse than the time you got crabs on senior prom weekend. After fighting tooth and nail through every other avenue, slapping the bankruptcy button is the Hail Mary that says, “I’m down, but not out.” Yeah, it’s admitting defeat, but it’s also gearing up for a fresh start—like shaving your head after a bad dye job.

Let’s not sidestep the truth: life post-bankruptcy discharge is like climbing the financial Everest—choppy, challenging, and cold. Yet with each careful step, each penny pinched, and every frugal decision, you scale a bit more of that monstrous debt mountain. And once you reach the summit, it’s clear: life after bankruptcy wears the face of hope, a testament to the grit and persistence that humans are capable of. It’s the beginning of round two in the ring of fiscal responsibility, and if you’ve learned your lessons, this time, you’re going toe-to-toe with those dollars like a money management ninja.

FAQ

Who should consider filing for bankruptcy?

Bankruptcy should be like that break-glass-in-case-of-emergency box—only for when you’re financially on fire. If you’re swimming in debt deeper than the Mariana Trench and it feels like your assets are handcuffed to an anvil, it might be for you. It’s the financial equivalent of a hail Mary; when your debts have turned into a monster and you’ve got no cookies left to feed it. Before you dive in, make sure to chat with a financial advisor to explore every last option. There is finality and closure to be found in bankruptcy for those who truly need it—it’s not just for spendthrifts with a penchant for financial hara-kiri.

Could filing for bankruptcy impact my job or future employment?

Umm yeah, and I can speak firsthand to that. Mr Ex actually used this to destroy me as part of a sick game of financial abuse, enabled by the lovely and crooked Superior Court of Monmouth County NJ. Before i declared that I wanted a divorce, I had close to an 850 credit score, a thriving career, and a very bright future. Now, I’m writing this blog. Some Most employers run credit checks and might will frown upon a bankruptcy in your history, regarding it as a sign of unreliability or worse, a security risk. It’s like showing up to a first date and leading with, “So, I’m broke and irresponsible.” Not all industries care, but if you’re eyeing a gig in finance, security, or government, it could be as difficult as trying to nail jelly to a wall. So, keep that in mind before you jump onto the bankruptcy bandwagon.

What are the implications of bankruptcy for my everyday life?

The bankruptcy fiesta entails more than just financial changes. It’s a lifestyle makeover! You might find it tougher to rent an apartment, get utilities without a hefty deposit, or land some jobs, especially where they’re picky about credit history. Plus, it’s a public affair, so your financial mishaps become everyone’s business. On the bright side, it’s a lesson in budgeting, money management, and the art of the cash-only lifestyle. Think of it as involuntary financial enlightenment!

Are there any financial benefits that actually last after declaring bankruptcy?

Believe it or not, yes. After declaring bankruptcy and enduring the credit hit apocalypse, you’ll likely be free from a mountain of unsecured debt—think medical bills, credit cards, and the like. It’s like financial weight loss, but with paperwork instead of a gym. Some assets may be protected thanks to exemptions, so you don’t end up like a country song – lost your house, your car, and your dog. Lastly, if you’re doing the Chapter 13 shuffle, you’ve got a court-mandated plan to keep the roof over your head while you repay your debts. So, while your credit’s recovering, at least your savings won’t be playing hide and seek with creditors.

How does bankruptcy affect my credit, exactly?

Affect your credit? It’s like a bull in a china shop, my friend. Filing for bankruptcy means your credit score takes a dive, and this little misadventure sticks with you for 7-10 years. Future loans or credit cards will come with higher interest rates, if at all. It’s like having a Scarlet ‘B’ for Bankruptcy that everyone can see when you try to borrow money. The credit world has become a lot less friendly, so prepare for a bumpy ride and maybe a bike instead of that new car.

Can you give me the lowdown on bankruptcy’s downsides?

Oh, where do I start? First, waving the white flag to the tune of bankruptcy can tank your credit score faster than a lead balloon. It stays on your credit report for up to a decade, making lenders about as willing to trust you with money as a cat with a goldfish. Expect to pay more in interest if you manage to snag a loan, and get used to the word ‘no’ a lot. Not to mention, you’ll be spilling the beans on your financial life to the public – yikes. Plus, those filing fees and attorney costs? They’re like salt to a financial wound.

What are some advantages of filing for bankruptcy?

Well, let’s get the party started with some good stuff, shall we? Filing for bankruptcy means you get an automatic stay against creditors, halting foreclosures, repossessions, and never-ending calls. Imagine the sweet silence! Plus, declaring bankruptcy can wipe out some of that nasty unsecured debt and give you a shot at keeping necessary assets like your car and daily gear. And let’s not forget, under Chapter 13, you even get to stay in your pad while you sort out a repayment plan. It’s like a financial reset button… minus the easy part.